The Foundations of Islamic Finance

Dr. Mohammad Nejatullah Siddiqi , Thursday 25 October 2001

Dr. Muhammad Nejatullah Siddiqi is Professor of Economics, Centre for Research in Islamic Economics King Abdulaziz University, Jeddah, Saudi Arabia. He has written numerous books in English and Urdu as well as numerous articles and lectures.

(Delivered at the Anderson Graduate School of Management, University of California , Los Angeles on 25 October 2001)

Friends, colleagues and dear students, thank you for coming. I hope you will not regret the decision. You are about to hear the story of a unique phenomenon.

During the short span of a quarter century, a new way of financial intermediation and investment management emerged and gained a sizeable part of the market – between a fourth and a third – in its home base, the Persian Gulf countries. During the same period it spread far and wide reaching Malaysia and Indonesia in the east and the Americas in the west, and a number of Muslim countries adopted the new system at the state level.

It is interesting to ask why it emerged, how it works, what sustains it and what are its potentialities for you and me and the humanity at large. The query is timely as all is not well with our conventional system of money, banking and finance. It has become increasingly unstable, facing recurrent crises. It has failed to help in reducing the increasing gap between the rich and the poor, within nations and between nations. Many think it is partly responsible for increasing inequality.

Today I cover only the foundations of banking and finance in Islam: its concepts, precepts and laws with some reference to its roots in early Islamic history. The story of its recent emergence and spread will be covered in the next lecture. I reserve the third and the last for a closer look at the contemporary scene and the challenges facing Islamic finance today.

The Foundations

Islam looks at wealth as life sustaining, to be used efficiently. God says:

Give not unto the foolish your wealth which Allah has made a means of support for you(Quran, 4:4).

Private ownership is affirmed but viewed as a trust:

Believe in Allah and His messenger, and spend of that whereof He hath made you trustees..(Quran, 57:7).

Islam encourages enterprise, efforts to create wealth, which has been characterized as Gods bounty:

And when prayer is ended, then disperse in the land and seek Allah’s Bounty.. (Quran , 62:10).

Muslims are obligated to fulfill contracts and keep their promises:

O you who believe! Fulfill your undertakings. (Quran, 5:1)

…And be true to every promise, for, verily, ( on judgement day) you will be called to account for every promise you made (Quran, 17:34).

All exchange should be with willing consent of the parties concerned:

O you who believe! squander not your wealth among yourself in vanity. Except it be a trade by mutual consent (Quran, 4:29)

Use of wealth and exercise of freedom of enterprise is constrained by the obligation not to harm others. The Prophet ruled:

No injury, and no inflicting of injury (Ibn Maja, Sunan: chapter on Ahkam)

This has to be seen in the perspective of the positive obligation to care for others and share with them. This is symbolized by the well known duty of paying Zakat or poor tax. But that is not all, the important thing is the spirit of a cooperative, helpful behavior as mandated by the Islamic view on life being a test:

Who hath created life and death that He may try you, which of you is best in conduct..(Quran, 67:2).

These clear texts provide a sound basis for a positive attitude towards wealth creation and economic activity. Clear and secure individual ownership rights, one’s right to the fruits of one’s efforts and contracts enforceable through a social authority, strengthen that attitude and provide a wide arena for it.

Limits of Freedom

Having put production and exchange of wealth on a firm basis, Islam proceeds to define a framework for these activities so that justice and fairness is ensured for all concerned. This comprises dos as well as do-nots. I focus on the do-nots as they are more relevant to our discussion. The following are prohibited:

1 Riba, i.e. interest on loans and exchange of unequal quantities of similar fungibles. Gold or silver or a particular paper currency must be exchanged in equal quantities. When gold or silver or different paper currencies are exchanged with one another, the quantities can be unequal but the exchange must be simultaneous. Prohibition of interest on loans is clearly implied by the text of the Quran:

And if you repent you have your principal, wrong not and you shall not be wronged (Quran, 2:279)

As we shall note later on, this and the prohibition of gambling which is next on the list, target justice in distribution. Islamic law does not distinguish between high rates of interest characterized as usury and lower rates characterized as interest. Any excess over and above the sum lent is disallowed. There have been some modern scholars taking a different view but classical jurists as well as overwhelming majority of modern scholars take the stand reported above. It is this view which is reflected in Islamic banking and finance.

2. Maysir, i.e. gambling, bets and wager. The essence of gambling is taking a risk deliberately created or invited, which is not necessary in economic activity, to gain thereby. This is unlike the risks taken by other economic agents, entrepreneurs, speculators, insurers….which are there as an inalienable aspect of reality.

3. Ghabn, i.e. fraud and deception.

4. Ikrah, i.e. coercion, e.g. imposing a contract, or a condition therein, on an unwilling party.

5. Bay’ al -mudtarr, i.e. exploitation of need, e.g. by charging an exorbitantly high price.

6. Ihtikar, I.e. withholding supplies of essential goods and services with a view to raising prices.

7. Najsh, i.e. raising prices by manipulating false bids.

8. Gharar, i.e. hazard or uncertainty surrounding a commodity, its price, time of payment, time of delivery, quantity,.. etc. makes the deal invalid. But some little gharar can be ignored as it may be humanly impossible to eliminate it.

9. Jahl mufdi ila al-niza’, i.e. such lack of information about a commodity, its quantity, price, etc. as may lead to dispute.

This list is by no means all inclusive, rather it serves the purpose of highlighting what the Shariah (Islamic Law) cares about in order to guide men and women towards an efficient and just economy.

I would also underline the fact that other than prohibition of interest, regulators all over the world, especially in the United States of America, have been doing their best to rid the markets from the bad practices noted above. In other words most of the concerns of Shariah and modern commercial law are common.

As I noted earlier, these do-nots are to be seen in the perspective of the numerous dos Islam has mandated, those that enshrine the spirit of caring for other human beings and, as need be, sharing with them one’s hard earned income and wealth. Economic agents, be they individuals, groups or institutions, are also under the obligation of regarding public interest and social purpose in their decisions. However, a detailed discussion of this point is not warranted in this lecture.

Early Islamic History

True to its view on life, Islamic society witnessed vigorous economic activity since the day the Prophet came to Madinah. To the agrarian community of the city state was added a group of experienced traders from Makkah, a great center of inter- regional trade. The first four to six centuries recorded continued expansion and increasing prosperity. Monetization came early, and the ban on unequal exchange of similar fungibles seems to have expedited the process. Muslims started with gold dinars from the Byzantine and silver dirhams from Persia, but very soon they took to minting their own coins. The state had the monopoly of coinage and any tampering with their weight or purity was severely punished.

It is not surprising that trade and commerce over the vast expanse of the world of Islam, including northern parts of Africa, Spain in Europe and a large part of Asia , soon produced certain elementary financial instruments.

Chief among these was suftaja (bill of exchange) and sakk(check).

Muslims used customary contracts known in the Arabian peninsula and other parts of the land of Islam. But some were found violating one or more of the limits noted above and, therefore, rejected. Some were modified to meet the standards of fairness. Thus the Prophet forbade traders from selling what they did not yet own. He also forbade selling pieces of cloth spread on the ground by inviting the customer to throw pebbles in their direction, getting the piece actually hit. Muawiya, the first Umayyid khalifa (661-680) banned trade in securities based on grain entitlements of recipients.

It is time now to focus on those contracts, other than simple sale and purchase, which have a closer relationship with investment, finance and business organization. It is these which were recently adapted to modern conditions to form the basis of Islamic banking.

Profile of Early Islamic Financial Contracts

Mudaraba, i.e. profit-sharing. Supplier of money capital contracts with a working partner on the basis of sharing the resulting profits. Losses, if any, are considered loss of capital and borne by the owner of capital. The working partner, in that case, goes unrewarded for its efforts. This is the ‘loss’ borne by the working partner, a feature of mudaraba which has made some to characterize it as profit and loss sharing or PLS.

The sharing contract when applied to farming, is called muzaraah or share-cropping.

Shirka, also called musharaka, i.e. partnership. In partnership two or more parties supply capital as well as work/effort. They share the resulting profits according to agreed proportions, but losses are to be borne in proportion to respective capitals.

Wakala, i.e. agency. Business is managed by an agent appointed by the principal-owner. Agent’s compensation may take different forms.

Ju’ala, i.e. reward which is given on successful completion of a specified job. There is no compensation in case of failure.

Ijara, i.e. leasing.

Salam, i.e. payment now for agricultural products to be delivered at a specified time in the future, with the price being agreed now.

Istisna’, i.e. salam applied to manufactured goods, with the possibility of payment in installments as the goods are delivered.

Urboon, i.e. depositing a small fraction of price in a deal to be concluded in future. It binds the seller to wait but allows the buyer to back out of the deal, with the seller keeping the deposit.

Murabaha, i.e. a sale agreement under which the seller purchases goods desired by a buyer and sells it to him/her at an agreed marked up price, payment being deferred. It is also referred to as bay’ mu’ajjal or bay’ bi thaman aajil. It is a modern adaptation of an earlier contract in which deferment was not necessarily involved. The higher price paid would leave a margin for the seller in order to reward him/her for expertise in bargaining, better knowledge of market conditions, etc.

It may be noted that Islamic law allows a seller to sell on credit at a price higher than he/she was charging for payment on the spot. In fact it is regarded to be an aspect of freedom of enterprise, the seller’s freedom to ask for a price he/she thinks fit to cover his/her costs and leave a decent profit. It is not like asking for an excess over cash lent in view of time, the time that passes between borrowing and repayment. No price is involved in a lending transaction. The object of the transaction in murabaha is a commodity with its perceived utility to the buyer, whereas the object of transaction in a loan is money which gives its services through being converted into commodities. Unlike commodities whose services are known and not necessarily time related, the services of money involve time and are surrounded with uncertainty.

Trade credit has always played a major role, and it was no different in early Islamic history.

This list should also include qard, i.e. loan – which has to be interest free. Since lending does not bring any material benefit to the lender it is classified with charity and called ‘qard hasan’ – good loan or beneficial loan. It played a significant role in financing consumption of the poor and needy but its role in business enterprise has been marginal, except in the form of trade credit, which changes its nature.

As noted above, for centuries Muslims were able to carry on international trade as well as domestic economic activities — agriculture, industry and trade — on the basis of the above mentioned practices without resorting to interest based contracts on any large scale. As Professor S.D.Goitein has recorded in his monumental work, A Mediterranean Society, partnership and profit-sharing and not interest based borrowing and lending formed the basis of commerce and industry in twelfth and thirteenth centuries (sixth and seventh in Islamic calendar) in the Mediterranean region.

( S D Goitein, A Mediterranean Society,vol.2, Berkley and Los Angeles, University of California Press, 1971)

A Realistic Approach.

Prohibition of interest on the one hand and permission to charge a higher than spot price in credit sales on the other hand makes the Islamic model of finance unique. In order to realize its significance one should consider the many financial needs which are not easily amenable to profit-sharing. These are the cases in which there is nothing to share as the project involved is not a for profit activity. Also relevant are cases of business enterprise which are difficult to monitor. The inclusion of trade based modes of financing like murabaha, salam and leasing along with sharing based modes makes the package of Islamic contracts capable of accommodating all kinds of financing needs. What is important to note at this stage is that both kinds of contracts are rooted in early Islamic practice.

http://siddiqi.com/mns/Lecture1.htm

Leave a comment

Also in FINANCE & ECONOMICS

Recent History of Islamic Banking and Finance

Islamic Banking- an Analytical Essay

Problems and Prospects of Islamic Banking and Finance

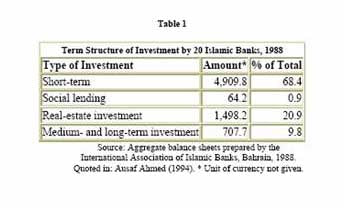

During the last few decades of the twentieth century, the period in which Islamic banking and financial institutions were evolving, great changes were taking place in the financial environment. In this lecture I will examine the problems and prospects of Islamic banking in the perspective of these changes. Two changes are most significant, decline in intermediation and resort to more active, rather aggressive management of investment, and world-wide integration of financial markets in the wake of globalization.

The first trend, symbolized by the repeal of Glass-Steagal in the United States, should be advantageous to Islamic finance insofar as financial intermediation was based on interest. Greater involvement of banks/financial institutions in investment management afforded wider scope for using the Islamic financial techniques of profit-sharing, mark up financing, etc.