Problems and Prospects of Islamic Banking and Finance

Dr. Mohammad Nejatullah Siddiqi , Tuesday 13 November 2001

Dr. Muhammad Nejatullah Siddiqi is Professor of Economics, Centre for Research in Islamic Economics King Abdulaziz University, Jeddah, Saudi Arabia. He has written numerous books in English and Urdu as well as numerous articles and lectures.

(Delivered at the Center for Near Eastern Studies, University of California, on 13 November 2001)

During the last few decades of the twentieth century, the period in which Islamic banking and financial institutions were evolving, great changes were taking place in the financial environment. In this lecture I will examine the problems and prospects of Islamic banking in the perspective of these changes. Two changes are most significant, decline in intermediation and resort to more active, rather aggressive management of investment, and world-wide integration of financial markets in the wake of globalization.

The first trend, symbolized by the repeal of Glass-Steagal in the United States, should be advantageous to Islamic finance insofar as financial intermediation was based on interest. Greater involvement of banks/financial institutions in investment management afforded wider scope for using the Islamic financial techniques of profit-sharing, mark up financing, etc.

The problem is, investment management in modern conditions boils down to risk management which is very underdeveloped in Islamic financial theory and practice. Add to this the fact that, in Islamic perception, this is one of the areas of conventional finance in need of drastic reforms. This need was recently underlined by the story of Long Term Capital Management (LTCM ), ( told by Roger Lowenstein in his book, When Genius Failed, Random House, 2000 ). So we face a double challenge, to develop Islamic techniques of risk management and to see that these new techniques are free from the ills with which conventional methods are suffering. This is different from the challenge faced in the middle of twentieth century, to develop a method of financial intermediation free of interest.

Risk Management in an Islamic Framework

The task is stupendous. Mastery of risk may be regarded as the unique feature distinguishing the modern times. Some one has rightly remarked that elimination of risk has stolen the center stage from the elimination of scarcity as a major preoccupation.

Risk was always there, especially in business. But industrialization brought risks unknown in trade and agriculture. Industrial production often involves long periods of time .The longer the period of production the more the uncertainty. The scope of the market has expanded to cover the whole world, introducing new kinds of risk. More than a thousand years ago, when Islamic laws were being written, the nature and scope of risk and uncertainty was different. However, something can still be learnt which, in combination with the modern experience, should enable us to realize the Shariah objectives of justice, fairness and efficiency.

The Prophet is reported to have prohibited the sale of an unborn calf, i.e. one still in its mothers womb. He is also reported to have prohibited sale of fish still in the pond. In both cases the reason is the uncertainty surrounding the quality and/or the quantity of the commodity being sold. Also, note that it was possible to remove the uncertainty involved to ensure fair dealing without killing the deal itself or causing unbearable inconvenience.

The Prophet is reported to have permitted the sale of fruits still on the trees and yet to ripe, despite the uncertainty as to quantity and/or quality present. It was not possible to wait till the fruits were fully ripe and were plucked and weighed or counted. That would leave no time for marketing.

The Prophet is reported to have prohibited the sale of a non- existent commodity. But he did allow salam, sale of an agricultural produce months ahead of the crop, provided the price was paid in advance at the time of contract. This was found to be advantageous to the farmer as well as the grain trader, hence the uncertainty present was tolerated for a purpose.

The message seems to be clear. Transactions need be based on complete information, as far as possible, in order to ensure neither party is under any illusion. But, given mutual consent, some uncertainty can be tolerated in order to secure larger advantages.

As to be expected, the juristic discussion of gharar (hazard, uncertainty) or transactions in absence of complete information is full of controversies. Some would care more for fairness and, hence, try to discourage transactions in situations of incomplete information. Others would give more importance to allow people enter deals they perceive to be mutually advantageous. I do not propose to enter into the details in the limited time available. I would rather draw attention to what exactly is involved in terms of human needs and interests in situations in which contracts must cover the future in order for life to go on efficiently.

Risk, Speculation and Gambling

It is important, at this stage, to distinguish gambling, which must be avoided, and other kinds of risk taking. In the words of Irving Fisher, a gambler seeks and makes risk which it is not necessary to assume. All games of chance are of this nature. But life is full of risky situations which cannot be avoided. Business specially involves risk because production of wealth as well as some other transactions involve the future, and it is not possible to have full and certain information regarding the future. People arrive at ways to face these uncertainties that are mutually advantageous. We try to understand this through some examples.

A farmer sells future contracts of grain i n order to protect himself from a fall in price, whereas a food processor buys future grain contracts in order to protect himself from a rise in prices. Both benefit. Even though each one is taking some risk, total risk is now less and both can go ahead with their production plans on the basis of agreed prices. Another example is oil futures sold by oil companies and purchased by airlines. Without these contracts possible fluctuations in oil prices would make future planning in both industries almost impossible.

Since direct deals between farmers and food processors or oil companies and airlines would be cumbersome and costly, it is efficient to have middlemen/intermediaries. Some sort of clearing arrangements soon follow. In short we have a new market for commodity futures. There is a role in this market for speculators. They do not, like gamblers, create or invite the risks they are dealing with. These are business risks which had to fall some where. Speculators take these risks, pool them, repackage them into parcels more acceptable to some in terms of quantity, quality, time involved, etc. Speculators take risks in order to make a profit thereby. They specialize in transferring risks to those willing to take them. They also allocate risk over time. Future markets have decisive impact on spot markets, making them more stable.

Current research in these matters and on the subject of risk management in Islamic framework in general, is inconclusive. The position is the same when we consider the currency markets. Contractors need different currencies at different points of time in order to fulfill production plans extending far into future and involving inputs from several currency areas. To make a commitment to do a job like delivering an aircraft or a shopping complex or an airport at a price denominated in a single currency at the time of the contract, the firm doing the project has to ensure that requisite amounts of other currencies are available at the proper time to buy the inputs needed. This involves buying foreign currencies in advance, something not permitted in Islamic law as interpreted at the present. Some scholars do, however, find a way through binding promises doing the job of actual contracts.

Current methods of dealing with uncertainties in the financial markets involve dealing in derivatives. These are innovations with little by way of precedents in the past. Some Islamic scholars find the old practice of urboon, i.e. depositing a small fraction of price in a deal to be concluded in the future, capable of justifying some kind of options which are the simplest kind of derivatives. This could be the first step towards a broad range of derivatives, some of them based on futures.

Financial Markets

It is time to wind up this discussion of financial markets in Islamic framework with a synoptic view of the situation. If we classify financial transactions into:

Money for money

Money for equity

Money for debt

Debt for equity

Debt for debt

Equity for equity

Prohibition of interest seems to affect all the three markets into which debt figures, insofar as debt can be traded only at par. Money for equity poses no problems. Nor does the swapping of equity for equity. I have already noted the problem relating to the currency market. The overall conclusion is that financial markets under Islam will be smaller as compared to their size in an interest based regime, all other things remaining the same.

Islamic economists think it will be good for society. The ballooning of the financial sector out of all proportions with the real economy has undesirable consequences for the distribution of income and wealth. It also makes it amenable to gambling like speculation.

But a too restrictive approach on part of Islamic scholars in the name of minimizing gharar (hazard, uncertainty ) and blocking the road to riba (sadd zariah ) runs the greater risk of stifling genuine economic activity by reducing the amount of liquidity available on the one hand and increasing the total amount of risk on the other hand. The overall result could be Muslim societies run in accordance with these restrictive interpretations of Shariah lagging behind in economic progress and losing out to others, eventually, politically and culturally also. Instead of being the heralders of a more just, more stable and more efficient financial regime they would then serve only as a warning against a religious and moral approach to money, banking and finance. That would be a disaster that needs not be. It is hoped the new generation of Islamic economists will rise to the challenge posed by this situation.

Globalization of Financial Markets

This is the second change I mentioned in the beginning. Financial markets the world over are integrated as never before. Money moves across national boundaries without cost and instantaneously. The few remaining exceptions are on the way out. In principle this change should be favorable to Islam which never cared much for national boundaries. In practice however it does pose problems for Islamic financial movement, for two different reasons. Firstly the home base of this new trend is the Middle East and South and South East Asia where the economies are small and financial system less sophisticated than in the developed countries. Secondly, Islamic financial institutions themselves suffer from smallness in size and very few of them operate in more than one country as the major players in the field do. The situation has changed with the entry of some major conventional financial institutions into the field. But that has made it harder for the older Islamic financial institutions, obliging t hem to consider mergers and consolidation.

Globalization has increased the volatility of almost every financial variable, especially the exchange rates. It has also reduced the efficacy of national economic macro-management. The redress can only come through international agreements curbing speculation and regulating the financial markets. The insights of the Islamic financial movement relating to sharing modes of finance, commodity-linked financing like murabaha, and reducing the role of debt have great potential in this regard.

Prospects at the State Level

There is a lull in the state sponsored Islamic finance. Pakistan, which took the lead, is in a flux. With the economy skidding and burdened with huge domestic and foreign debt, it is faltering in its resolve to forge ahead with an innovative approach to money, banking and finance. Sudan, possibly emerging out of a period of being ostracized by western countries, sends no signals of being in a better situation. Malaysia was expected to do better after its emergence from the crisis that visited South East Asia in 1997-98, but the world wide recession looming on the horizon at this moment (November 2001) makes the prospects uncertain. Little is known about Iran, but at least there is no setback and no weakening of the political will. In short, no new initiatives are expected in state sponsored Islamic banking and finance in view of the difficult economic situations and political uncertainties in the countries pioneering the experiment.

Prospects in the Private Corporate Sector

Meanwhile progress has been made in the regulation of Islamic financial institutions by their respective national authorities in view of the increasing market share of these institutions. There is better understanding of Islamic finance by the monetary authorities and closer cooperation between them and these institutions, sometimes with the involvement of the Islamic Development Bank.

Efforts to standardize Islamic financial products continue. The standards developed by the Accounting and Auditing Organization of Islamic Financial Institutions are being adopted. The need to standardize such basic elements of Islamic finance as mudaraba, murabaha and ijara is widely felt as the present lack of uniformity is baffling. There are moves to coordinate the activities of the various Shariah advisory boards of Islamic financial institutions as the way they function remains a source of confusion.

There is a big information deficit in the Islamic financial industry hampering its further growth and development. The absence of rating agencies, specially agencies that would rate products as well as institutions on the ground of their Shariah compliance, is the biggest example of this deficit.

Despite odds, the industry continues to grow, especially in the Gulf countries. It has also reached the newly independent Central Asian Islamic Republics and the Balkans. But the weak economic conditions in those countries are naturally reflected in the state of their nascent Islamic financial institutions.

Prospects at the Grass Roots and the Community Level

The youngest Islamic financial institutions are found outside Muslim majority areas, in the Americas, Europe and India. Many of them have successfully completed their first decade of operations. All of them are growing in size. They serve their respective communities in interest free house finance and installment purchase of consumer durables, as well as in investing their savings on the basis of profit sharing. The possibilities of expansion are great.

Research and Development

All innovations need a base in research and development, which in turn draw on fundamental research in universities and laboratories. Islamic finance became a subject of research in universities in 1980s. The subject is discussed every year at high profile conferences in Bahrain, Harvard, and other places. Yet the resources devoted and the facilities available hardly match the challenges facing the industry.

As the Bank of International Settlements has noted, innovations in three directions are crucial: liquidity enhancement, risk transfer and revenue generation. In its early days Islamic finance had to focus on revenue generation as it had to compete with conventional finance and show comparable returns. Times have changed. The need to enhance liquidity, and hence to move towards greater securitization of assets, is already recognized as evidenced by the developments in Malaysia. The bottleneck at the present seems to be risk management.

Another important area awaiting innovative initiatives is a vision that encompasses Zakat(obligatory charity) Waqf (charitable endowments) and Islamic financial management. Securitazation can help mobilize the huge wealth locked into awqaf properties which in their turn can be developed by investment of zakat funds awaiting distribution. At the present only a small fraction of the liquidity generated by zakat passes through Islamic financial institutions, a situation reflecting the distance between the poor, non-banking population and these institutions.

The goal of progress with justice and equity inspires the entire humanity and there is no reason the potential of Islamic financial institutions contributing towards the realization of this goal remain unexploited. In the age of globalization no system that serves only the interests of a particular country or group of countries can evoke universal acceptability. Protection of small countries from speculators chasing instantaneous profits, reduction of the role of debt in international finance and financing projects helpful in reducing poverty and inequality deserve every ones attention.

http://siddiqi.com/mns/Lecture1.htm

Leave a comment

Also in FINANCE & ECONOMICS

Recent History of Islamic Banking and Finance

Islamic Banking- an Analytical Essay

The Foundations of Islamic Finance

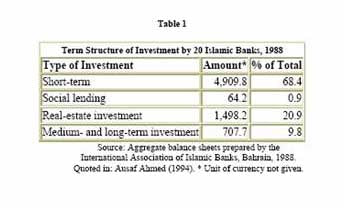

During the short span of a quarter century, a new way of financial intermediation and investment management emerged and gained a sizeable part of the market – between a fourth and a third – in its home base, the Persian Gulf countries. During the same period it spread far and wide reaching Malaysia and Indonesia in the east and the Americas in the west, and a number of Muslim countries adopted the new system at the state level.

It is interesting to ask why it emerged, how it works, what sustains it and what are its potentialities for you and me and the humanity at large. The query is timely as all is not well with our conventional system of money, banking and finance. It has become increasingly unstable, facing recurrent crises. It has failed to help in reducing the increasing gap between the rich and the poor, within nations and between nations. Many think it is partly responsible for increasing inequality.