Recent History of Islamic Banking and Finance

Islamic Banking- an Analytical Essay

The Foundations of Islamic Finance

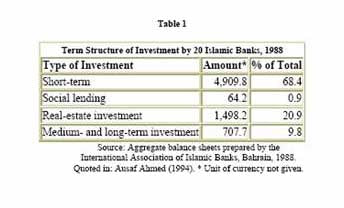

During the short span of a quarter century, a new way of financial intermediation and investment management emerged and gained a sizeable part of the market – between a fourth and a third – in its home base, the Persian Gulf countries. During the same period it spread far and wide reaching Malaysia and Indonesia in the east and the Americas in the west, and a number of Muslim countries adopted the new system at the state level.

It is interesting to ask why it emerged, how it works, what sustains it and what are its potentialities for you and me and the humanity at large. The query is timely as all is not well with our conventional system of money, banking and finance. It has become increasingly unstable, facing recurrent crises. It has failed to help in reducing the increasing gap between the rich and the poor, within nations and between nations. Many think it is partly responsible for increasing inequality.

Problems and Prospects of Islamic Banking and Finance

During the last few decades of the twentieth century, the period in which Islamic banking and financial institutions were evolving, great changes were taking place in the financial environment. In this lecture I will examine the problems and prospects of Islamic banking in the perspective of these changes. Two changes are most significant, decline in intermediation and resort to more active, rather aggressive management of investment, and world-wide integration of financial markets in the wake of globalization.

The first trend, symbolized by the repeal of Glass-Steagal in the United States, should be advantageous to Islamic finance insofar as financial intermediation was based on interest. Greater involvement of banks/financial institutions in investment management afforded wider scope for using the Islamic financial techniques of profit-sharing, mark up financing, etc.

The Economic System of Islam

Of all the beneficial principles propounded by Islam, none are more useful for humanity at large than those governing income and expenditure. The main sources of income to the Islamic Exchequer are Zakat, Ghanimhh, Jizyah (Tithe) and Kharaj. Zakat which literally means growth and purity is a tax on Muslim Capital owned beyond a certain minimum. Zakat occupies an important place amongst the (Farz) Fundamentals of Islam, the observance of which is binding on Muslims. It is an ordinance (Farz).

Islamic Banking

Happy the man who far from schemes of business, like the early generations of mankind, ploughs and ploughs again his ancestral land with oxen of his own breeding, with no yoke of usury on his neck – Horace

Background

The London Sunday Times of February 2nd 1997 wrote: “The advent of Islamic Finance will be a Godsend for them . It could also turn out to be a goldmine for the United Bank of Kuwait”.

There seems to be considerable demand for such Islamic banking products both in Islamic countries and in the West. To date, for a number of reasons including risk-aversion and conservatism, this need has gone largely unfilled.

The purpose of this article is to provide an introduction to “Islamic” banking. It does not attempt to provide a moral justification, rationale or even establish clear rules as to what is Islamic and therefore Halal and what is un-Islamic and therefore prohibited or Haram. But even if the reader has little interest in Islamic Banking per se there are important lessons to be learned from the creative process used to satisfy the Islamic regulations. There are numerous parallels with tax-driven structuring in conventional banking markets. Throughout the article there are references to familiar Western financial instruments.

How the Central Banks Can Accommodate Islamic Banks

Responding to the pressure of public opinion, however, the only way was to promulgate special laws exempting Islamic banks from the existing banks rules and even from the control of the central banks. Some Islamic banks were set up under the patronage of governmental authorities, which were, by nature, far from the ordinary banking systems. Examples are the Ministry of Social Affairs for the Nassar Social Bank in Egypt and the relevant Ministry of Awkaf (Religious Endowments) for the Faisal Islamic Bank of Egypt and Bahrain Islamic Bank.