Recent History of Islamic Banking and Finance

Dr. Muhammad Nejatullah Siddiqi , Wednesday 7 November 2001

Dr. Muhammad Nejatullah Siddiqi is Professor of Economics, Centre for Research in Islamic Economics King Abdulaziz University, Jeddah, Saudi Arabia. He has written numerous books in English and Urdu as well as numerous articles and lectures.

(Delivered at the Anderson Graduate School of Management, University of California, 7 Nov 2001)

During the eighteenth, nineteenth and the first half of the twentieth centuries almost all of the world of Islam was colonized by the European countries. They managed the economies and finances of these countries in their own interests and in their own ways. Other than the native elites who had to get involved, the Muslim masses stayed away from interest-based financial institutions. As the national consciousness grew and freedom movements promised to bear fruits during the second half of the last century, the urge to manage their affairs in accordance with their own values and traditions also emerged in these countries. Indonesia gained independence in 1945 and Algeria in 1963. In between these two dates, all Muslim majority countries became independent. The discussion on the management of their respective economies in order to promote their own interests had, as an offshoot, brought the Islamic financial movement into being. While nationalism made them focus on rapid economic development, religion, the other motivating force in freedom struggle, made many turn to Islam for guidance.

Theoretical Literature

Early theoretical work on the subject appeared during 1940s through 1960s, in Urdu, Arabic and English. The focus was not banking and finance in the narrow sense but the economic system as a whole. The writer would, generally speaking, criticize capitalism and socialism and proceed to outline a system based on Islamic injunctions relating to moderation in consumption, helping the poor, encouragement of economic enterprise, avoidance of waste, justice and fairness, etc. The poor tax, zakat, and prohibition of interest would be emphasized in this context. It would be argued that Muslims should not adopt the conventional system of money, banking and finance blindly. They must purge it of prohibited interest and modify it to suit the just and poor-friendly economic system of Islam. Some of these writers went beyond generalities and suggested that the early Islamic contracts provided sound bases for restructuring banking so that it was free of interest and served the goals of Islam. The youngest of Islamic countries, Pakistan, made the commitment to abolish Riba a part of its constitution.

Professional Muslim economists as well as Shariah scholars made significant contributions to the subject so that by the end of 1960s some kind of a blueprint of Islamic banking was available. Bankers and businessmen had also joined the task of evolving a workable model since efforts were on in several Muslim countries to put the idea into practice. The political conditions in Arab countries were not favorable for any initiative at the state level. But private practical initiatives had a greater chance of mobilizing the monies needed for such a venture in these countries, as we shall see when tracing the history of the practice of Islamic banking.

The earliest theoretical model was based on two-tier mudaraba, profit sharing replacing interest in bank-depositor as well as bank-borrower relationship. Islamic banks would be financial intermediaries, like conventional commercial banks, only they would purge interest from all their operations, relying on partnership and profit-sharing instead. They could operate demand deposits like their conventional counterparts and offer other services against fees, like other banks. Banks directly doing business and entering the real estate market in order to make profits for their depositors and shareholders (partners) was not a part of this model.

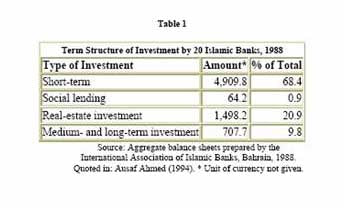

But practitioners in the Arab world did not see much scope in this model. Accepting deposits into investment accounts on profit-sharing basis was all right, but their profitable employment needed direct involvement in business. Merchant banking was also nearer to the milieu with which Shariah scholars were familiar. They felt more at home with a model in which savings were mobilized on profit sharing basis but their profitable use was based on familiar Islamic contracts of sale and purchase and leasing, etc.

Murabaha, i.e, cost plus or mark up financing entered into the model of Islamic banking in the second half of the nineteen-seventies. By this time practice had revealed the difficulties of applying the mudaraba (profit-sharing) contract in dealing with businessmen in a legal environment that failed to provide any protection to the financier in this case, unlike the protection it provided to interest based finance. Adverse selection in an environment dominated by interest-based institutions was another serious problem. Other Islamic contracts like salam, istisna’ and wakala were also being explored. Shariah scholars, many of them formally advising Islamic financial institutions, made significant contributions in developing the model.

One of the specific needs to meet was financing house purchase on terms acceptable Islamically. Three models of interest free finance were developed. The first, which formed the basis of the House Building Finance Corporation of Pakistan (1980), was based on joint ownership and rent sharing, eventually leading to the home dweller possessing it in full as he/she purchased the government owned part bit by bit. The second was a cooperative in which members pooled resources and got funded in turn, the pooled resources being profitably invested while waiting. The third method is based on murabaha, the customer paying the higher deferred price in installments.

In practice small variation were introduced to ensure Shariah compatibility as well as financial viability.

During 1980s the subject of Islamic banking and finance received broad based academic and professional attention. A number of Muslim countries began considering implementation of the idea officially and appointed expert bodies to work out the details. Several universities started teaching the subject and encouraged research resulting into hundreds of PhD dissertations, some of them in the universities in Europe and America. Numerous seminars and conferences drew attention to the subject in places as wide apart as Kuala Lumpur, Dhaka, Islamabad, Bahrain, Jeddah, Cairo, Khartoum, Sokoto ( Nigeria ), Tunis, Geneva, London and New York. A number of research centers made Islamic economics their field, paying special attention to money and banking. Some of these launched academic journals providing forums for exchange of views and dissemination of information on a world-wide scale.

During the 1990s the model was further developed and refined. The liabilities side saw frameworks put in place for handling trust funds, venture capitals, and financial papers based on ijara ( leasing ) salam ( forwards ) and murabaha (mark up ). The special techniques for launching Shariah compatible mutual funds were also developed in this period. This involved selecting companies whose shares could be traded as they did not violate any Shariah norms. This selection was made by screening out the undesi rables. The first norm was that the products in which the company dealt should not be prohibited ones like alcohol or pork. The other was that its finances should be free of interest bearing loans and its revenue free of interest income. Since the condition about debt finance would eliminate almost all shares traded on the stock exchange, some scholars allowed a leverage of 30% or less. There could be other criteria also but these two are the main, common to all existing Islamic funds. Once the filtering process was complete, managing a portfolio became a professional job. This is why the phenomenon of Islamic mutual funds, even though endorsed by a group of Shariah scholars, owes itself to the initiative of professional players in the field.

As the launching of the Dow Jones Islamic Indexes evidenced, Islamic finance too needed the modern tools designed to handle the complex web of financial transactions. The Indexes track Shariah compliant stocks from around the world.

Advantages of Islamic Banking and Finance

Before we turn to Islamic banking in practice, let us note some of its features emphasized in the literature.

Justice and fairness to all concerned was the main feature of a model of financial intermediation whose core was profit-sharing. Interest was essentially unfair because our environment does not guarantee positive returns to business enterprise financed with borrowed money capital. Current practice penalizes entrepreneurship by obliging it to return the principal even when part of it is lost due to circumstances beyond the entrepreneurs control. Justice requires that money capital seeking profit share the risk attached to profit making. A just system of financial intermediation would contribute to a more equitable distribution of income and wealth.

Islamic finance will foster greater stability as it synchronizes payment obligations of the entrepreneur with his or her revenues .This is possible only when the obligation to pay back the funds acquired from the financier and pay a profit is related to realization of profits in the project in which the funds are invested, as it is in the profit-sharing model. Contrary to this, in the debt-financing model the payment obligations of the entrepreneur are dated as well as fixed in amount. The same is the case with the financial intermediaries; their commitment to the depositors in time and saving accounts is to pay back the sum deposited with interest added. When a project fails and businessman defaults, the financial intermediary must also default with ripple effects destabilizing the whole system. The debt based financial system of capitalism is inherently prone to recurrent crises. This malaise of the capitalist financial system is well discussed by Hyman P. Minskey in his book, Stabilizing an Unstable Economy (New Haven and London, Yale University Press,1986.)

The linking of depositors entitlements to the actual profitability of the projects in which their monies are invested through the services of the financial intermediary, the bank, would almost eliminate the risk of runs on the bank insofar as the investment accounts are concerned. A report or rumor that the bank investments are not doing well will not prompt a rush of withdrawals from investment accounts as depositors could get only what is actually salvageable. Waiting till the situation improves would be a more rational option.

Islamic finance is more efficient as it allocates investable fund on the basis of expected value productivity of projects rather than on the criterion of creditworthiness of those who own the projects, as is the case in debt based finance. There is no guaranty that the most promising projects seeking finance will come from the wealthiest. As Schumpeter has shown the most innovative may be empty handed. But debt finance would not serve these. It would prefer those who, on the basis of other assets owned by them, would be able to pay back the sum borrowed, interest added, even when the project being financed failed to create additional wealth.

Last but not the least, Islamic finance will be less prone to inflation and less vulnerable to gambling-like speculation, both of these being currently fueled by the presence of huge quantities of debt instruments in the market. Debt instruments function as money substitutes while equity-based financial instruments do not. And speculators find it much easier to manipulate debt instruments than those based on profit-sharing.

It is true that these advantages belong to a system whose core is profit- sharing. But even murabaha (cost plus or mark up) financing keeps the system far less vulnerable to inflation and gambling-like speculation than the conventional debt based arrangements. Murabaha is firmly linked with exchange of real goods and services. It is a price, to be paid later. It is essentially different from money given as a loan which may or may not be linked to production or exchange of real goods and services. An Islamic system of finance in which profit-sharing and mark up financing both exist side by side would still retain the advantages noted above.

Islamic Banking Practice: Early Initiatives

A number of interest free saving and loan societies are reported to have been established in the Indian subcontinent during 1940s. But efforts to arrange finance for business enterprises seem to have started later. One pioneering but short lived experiment was that in Mit Ghamr in the Nile valley in Egypt in 1963. Same year saw the establishment of Tabung Haji in Malaysia. Money being saved for meeting the cost of the pilgrimage to Makkah is profitably invested by this organization which is still working. The Phillipine Amanah Bank was also established during the same period to enable Muslims to meet some of their financial needs without involving interest. An interest free bank in Karachi, Pakistan was established by some individuals around the same time but it did not survive for long.

Islamic Banking Practice In The Private Corporate Sector

The Dubai Islamic Bank was established in 1975 under a special law allowing it to engage in business enterprise while accepting deposits into checking accounts, which were guaranteed, as well as into investment accounts which were to receive a share in the profit accruing due to their use in business by the bank. Within the next ten years, i.e. by 1985, 27 more banks were established in the same manner in the Gulf countries, Egypt, Sudan, etc. Many more were to follow all over the Muslim world. Also by 1985, over 50 conventional banks, some of them located at money centers like London were offering Islamic financial products. This was followed by up by some of the major conventional banks establishing Islamic branches dealing exclusively in Islamic products. Citi-Islamic in Bahrain and Grindlays in Karachi were followed by the National Commercial Bank in Saudi Arabia establishing over 50 Islamic branches by 1990s.

Islamic investment companies and Islamic insurance companies also appeared in the late 1970s and grew in number. Later, in 1990s, a number of Islamic mutual funds appeared, many of them being managed by reputed Western firms.

By the year 2000, there were 200 Islamic financial institutions with over US$ 8 billions in capital, over $100 billions in depo sits, managing assets worth more than $ 160 billions. About 40% of these are in the Persian Gulf and the Middle East, another 40% in south and south-east Asia, the remaining equally divided between Africa on the one hand and Europe and the Americas on the other hand. Two thirds of these institutions are very small, with assets less than 100 million US dollars.

Two Islamic banks operated in Europe for some years. Islamic Bank of Denmark was converted into an investment company and Al Barakah London had to stop deposit taking. As the Bank of England explained, a deposit taking institution had to guarantee its repayment in full in order to qualify for a banking license. As of now, Western societies are served either by Islamic mutual funds or by grass roots initiatives at the community level financing the purchase of houses and other consumer durables.

Islamic Banking at the State Level

Pakistan ‘Islamized’ banking between 1979 and 1985 through a series of Ordinances issued by the Federal government and a number of circulars issued by the State Bank of Pakistan, the country’s central bank. Even though profit sharing replaced interest as the basis of time deposits and saving accounts, the actual rates paid are not market determined as all major banks were nationalized during the previous regime. On the assets side mark up became the main basis of bank finance for business. Some financial products based on profit-sharing were launched but their role in the market is minimal. Government finances remain conventional, burdened with huge interest based foreign and domestic debts.

Private initiative played little role in the Islamization process and the market hardly got a chance to throw up Shariah compatible financial instruments. The whole process was conducted with some speed by the bureaucracy under orders from the top. Even the recommendation of the Islamic Ideology Council to make a start from the assets side was not heeded.

Iran passed its usury free banking laws in 1983. All banks are nationalized. In accordance with the school of Islamic law followed in Iran, depositors may get ‘rewards’ on their savings provided they are not committed in advance. Financing of domestic and external trade is done on mark up basis. But sharing modes do play a significant role in financing agriculture and industry. Interest free loans are available for the poor to meet such needs as housing, their source being the state.

Sudan launched Islamic banking in 1984 whose coverage was later extended to the entire financial sector in 1989. Sharing based modes of finance are used in agriculture and industry and the government is considering sharing based investment certificates to be sold to public, the funds so mobilized to be used in developmental projects. The poor state of the economy stands in the way of the market playing any significant role in the process. But the recent phenomenon of oil as an increasing source of public revenue is likely to make a difference.

Malaysia had its first officially sponsored Islamic bank in 1983. All other banks also offer Islamic financial products. Overall supervision vests in the country’s central bank, Bank Negara Malaysia, which has a board of Shariah scholars to advise it. Malaysian Islamic financial system allows sale of debt instruments based on receivables from sale of real goods and services and those based on leasing. The government issues bonds (Malaysian Government Investment Certificates, MGICs) to be redeemed at par but carrying coupons conferring financial benefits that vary. Malaysia has an active Islamic money market trading in assets based securities.

Indonesia’s Bank Muamalat, established 1994 under state patronage, has about 400 branches all over the country. Its financial operations follow the Malaysian model. There are other smaller Islamic banks too, e.g. the Shariah Bank.

Turkey does not practice Islamic banking at the state level, but several Islamic banks were launched under special licenses in late eighties-early nineties. They are still functioning, along with other non-bank Islamic financial institutions.

The Islamic Development Bank

The Organization of Islamic Conference (OIC) took several steps culminating in the establishment of a bank of Islamic countries which would serve the entire Muslim Ummah ( community of the faithful). Share capital, initially fixed at US dollars two billion was supplied by member countries the largest coming from Saudi Arabia, Kuwait, Libya, United Arab Emirates and Iran. It started operations in 1975 with headquarters at Jeddah, Saudi Arabia. Clause one of its charter states that it was to foster economic development and social progress of member countries and Muslim communities individually as well as jointly in accordance with the principles of shariah. In compliance, the IDB does not deal with interest.

By the year 2000 the Islamic Development Bank (IDB) had financed inter-Islamic trade to the tune of over 8 billion US dollars mostly using the mark up technique. It also gives loans, taking only service charges according to actual administrative expenditures. But it does try to promote sharing based modes of financing. It is also managing an investment portfolio in which individual Islamic banks place their surplus liquidity. Even though it can not, and does not aspire to, serve as a lender of last resort for all Islamic banks, it is trying to help them solve their liquidity problems. It fosters technical cooperation between member countries and has established or sponsored a number of institutions for this purpose. The Islamic Chamber of Commerce and the Islamic Foundation for Science, Technology and Development are two of these. It is also distributing scholarships for higher learning and technical education to Muslim students in countries in which Muslims are in a minority.

In order to fulfill its mission, the IDB has established the Islamic Research and Training Institute (IRTI). It conducts in house research, sponsors external research, publishes a research journal, conducts training courses, organizes seminars and conferences and maintains a data base on Islamic countries economies, etc. The Islamic Development Bank interacts with all regional and international financial institutions like the International Monetary Fund (IMF), the World Bank, the Asian Development Bank, etc.

Islamic Banking and Finance as Part of the International Community

The IMF issued its first study on Islamic banking in 1987. Since then more than a dozen research papers have come from that forum on important aspects of Islamic finance. IMF has reported no problems in dealing with member countries committed to Islamic banking. On the other hand Islamic financial institutions too never faced any problems dealing with regional and international financial institutions. The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) is in contact with the standards committee of the Bank of International Settlements based at Basel, Switzerland.

All Islamic financial institutions operate within the system supervised by their respective central banks and other relevant authorities. They are neither working in isolation nor engaged in creating a separate space of their own. They are inspired by a vision of financial arrangements more conducive to justice and development for all, especially the poor and the weak. This is a goal hopefully cherished by all.

http://siddiqi.com/mns/Lecture1.htm

Leave a comment

Also in FINANCE & ECONOMICS

Islamic Banking- an Analytical Essay

The Foundations of Islamic Finance

During the short span of a quarter century, a new way of financial intermediation and investment management emerged and gained a sizeable part of the market – between a fourth and a third – in its home base, the Persian Gulf countries. During the same period it spread far and wide reaching Malaysia and Indonesia in the east and the Americas in the west, and a number of Muslim countries adopted the new system at the state level.

It is interesting to ask why it emerged, how it works, what sustains it and what are its potentialities for you and me and the humanity at large. The query is timely as all is not well with our conventional system of money, banking and finance. It has become increasingly unstable, facing recurrent crises. It has failed to help in reducing the increasing gap between the rich and the poor, within nations and between nations. Many think it is partly responsible for increasing inequality.

Problems and Prospects of Islamic Banking and Finance

During the last few decades of the twentieth century, the period in which Islamic banking and financial institutions were evolving, great changes were taking place in the financial environment. In this lecture I will examine the problems and prospects of Islamic banking in the perspective of these changes. Two changes are most significant, decline in intermediation and resort to more active, rather aggressive management of investment, and world-wide integration of financial markets in the wake of globalization.

The first trend, symbolized by the repeal of Glass-Steagal in the United States, should be advantageous to Islamic finance insofar as financial intermediation was based on interest. Greater involvement of banks/financial institutions in investment management afforded wider scope for using the Islamic financial techniques of profit-sharing, mark up financing, etc.